Your End-to-End

Global Startup

Investment Partner

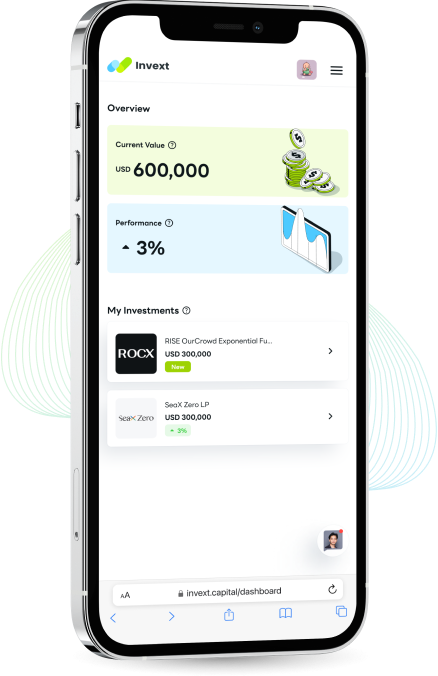

Invext enables investors to invest in top-performing venture capital funds and high-growth startups globally with confidence.

Sign up to See All Investment Opportunities

Exclusive investments and detailed information are available for verified members only.

Featured Investment Opportunities

Discover global investment opportunities in startups and venture capital funds curated for growth potential.

OC Fund I

Orange Collective is an independent fund built by Y Combinator alumni—that backs the most promising YC AI startups early, leveraging deep insider networks to capture top-tier deals for its limited partners.

Region

USA

Stage Focus

Pre-Demo Day and Select YC Alumni

Verdant Robotics

Verdant Robotics’ core technology combines artificial intelligence, computer vision, and automated robotics to empower farmers and help them achieve better yield, reduce cost, and rely less on human labor.

Region

USA

Stage Focus

Bridge Round

Type One Energy

Stellarator technology to transform energy markets with fusion power.

Region

USA

Stage Focus

Convertible Debt

High Risk, High Reward

Why invest in startups?

Investing in startups is the practice of providing capital to early-stage companies with the potential for high growth and returns.

Startup investing is considered a high-risk, high-reward investment opportunity, as many startups fail, but those that succeed can generate significant returns for investors.

Source: Preqin Pro. Most up-to-date data

Why Invest with Invext?

Exponential Returns from Exponential-Growth Startups

With our expertise in startup investment, you can expect an average internal rate of return (IRR) of over 25%* made by top-quartile VC firms in early-stage companies over a 10-year period.

* According to Cambridge Associates

Worldwide Investment Opportunities

Through global connections with high-performing venture capital funds and startup ecosystem, we are able to connect you with a diverse range of investment opportunities across various sectors that you can select and invest in.

Global Community of Accredited Investors

You will have opportunities to gain practical experience and deeper knowledge from experienced investors to invest with confidence and become a successful investor yourself via talks, workshops, and consulting sessions.

How to Invest

Accredit Your Account

Complete a quick accreditation questionnaire about your investment experience. Our team will reach back to you with in 1 business day.

Choose a Deal

Review the investment thesis, team, terms, and other key details. Choose a deal that matches your investment objectives.

Invest

Submit the documents and transfer your committed capital to the selected deal. You will receive quarterly reports on the deal`s performance.